Less Number Crunching, More Strategy: How AI Is Revolutionizing Finance

Sage IntacctWith Sage Intacct, finance professionals and CFOs can let artificial intelligence do the heavy...

January 31, 2023

Blog > Steer Your SaaS Ship Through Stormy Financial Seas With Sage Intacct

Uncertain times reveal new opportunities.

There’s been a downturn in American financial markets—but rather than panic, subscription business CFOs can successfully navigate the storm.

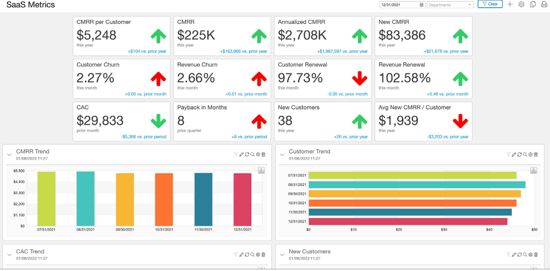

Now is the time to take a deep dive into your SaaS metrics. Valuations and investor expectations have changed for early-stage SaaS businesses. CFOs can seize the opportunity to reexamine their approach and ensure it aligns with changing market conditions.

Here are four areas to focus on.

This isn’t a defense strategy; it’s a different kind of offense approach.

It’s easier, less time-consuming, and cheaper to keep your existing customers happy than chase new ones—and not just during turbulent times.

While this may seem like a passive move, it’s actually an active business move that contributes to your bottom line.

Your subscription upsells and upgrades are essential data points because they provide critical sources of revenue when churn is likely high and new subscriber numbers are likely low.

A complete SaaS finance tech stack is a great way to monitor and improve the situation.

The best way to do this is by obtaining hard data on key performance areas.

Examine:

Consider implementing plans to further motivate top performers. Examples are higher commissions and quarterly competitions with prizes.

Net revenue retention (NRR) for different customer types and product segments is a vital defense metric.

NRR helps you objectively identify your most profitable customers and products so you can devote more time and resources to them.

If you ignore your NRR, you could throw time and money at ideas that will never gain steam.

Your cash burn rate (CBR) is the best way to be more strategic with your cash flow and how you track it.

During economic boom times, most businesses have a growth-oriented mindset about cash flow. But during a market downturn, businesses must be conservative about their cash.

One way to achieve this is with automation. A modern, cloud-native financial management solution like Sage Intacct automates SaaS accounting and saves significant time and money.

You can also shift to fixed expenses to bring much-needed predictability to your balance sheet during unpredictable times.

Download our free eBook, Navigating the Market Downturn With Better SaaS Metrics, to learn more about the four metrics discussed above.

Subscribe to our newsletter to receive our latest blog posts, case studies and ERP news delivered straight to your inbox.

With Sage Intacct, finance professionals and CFOs can let artificial intelligence do the heavy...

Automation and AI enable CFOs to shift from manual processes to strategic, data-driven...

Sage Intacct automates processes and seamlessly integrates with critical business systems like CRM,...

Recieve our latest blog posts, case studies, and ERP news

delivered straight to your inbox.